When AI Stops Being a Project and Becomes a Strategy: The Lesson from Norges Bank

For decades, Artificial Intelligence was treated as a future promise or an experimental project within organizations. While many still debate whether the technology poses a threat to jobs or is merely a tool for efficiency, the world’s largest sovereign wealth fund, Norges Bank Investment Management (NBIM), has taken a radically different approach: AI is not an auxiliary tool, it is a central part of operations.

This paradigm shift not only generates impressive numbers in productivity and cost savings, but also reveals a deeper dimension: AI's ability to expose biases, flawed decision-making patterns, and organizational behaviors that previously went unnoticed.

The Mindset Shift

At NBIM, AI has moved from being an isolated innovation project to becoming a core business. The adoption of Claude, Anthropic’s model, was not seen as a technological test, but as the inclusion of a new “team member,” directly participating in critical processes: conference calls, reports, trading decisions, and even internal votes.

The difference is conceptual: while many companies still try to fit AI into specific tasks, Norges Bank integrates it as decision-making infrastructure.

Measurable Results

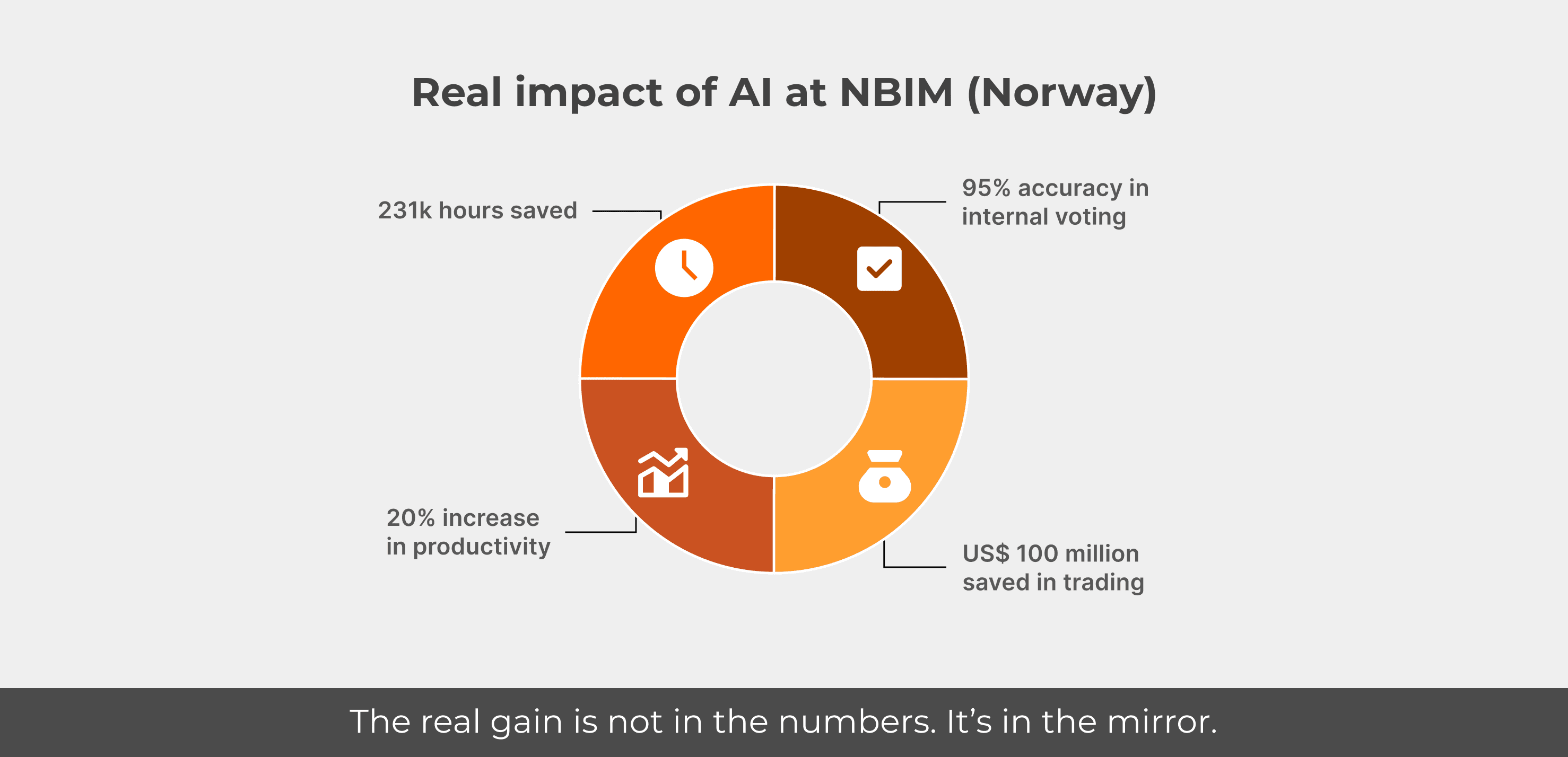

The gains achieved by implementing AI at NBIM are clear and significant:

- 213,000 hours saved in internal processes.

- $100 million saved in trading operations.

- 20% increase in team productivity.

- 95% accuracy in internal voting processes.

These numbers not only validate the investment, but demonstrate that AI is already capable of transforming highly complex operations involving billions of dollars and strategic global decisions.

The True Impact: An Organizational Mirror

Despite the financial results, the greatest gain is not in the savings or productivity reports. AI has become a lens to reveal what was previously invisible:

- Cognitive biases influencing internal votes.

- Repetitive decisions justified by “experience” with no real basis.

- Ego and hierarchy patterns distorting critical analysis.

By automating part of its operational intelligence, NBIM exposed the human factor in its rawest form. AI did not replace people, it revealed where people were deceiving themselves. And that represents a silent cultural revolution.

Consequences for the Global Market

The Norges Bank case foreshadows a future in which AI is no longer a competitive edge, but a mandatory infrastructure to operate at scale. If the largest sovereign wealth fund in the world has already embedded AI at its strategic core, the question is no longer if companies should adopt it, but when and how.

Organizations that treat AI merely as a peripheral tool risk getting stuck in an endless stage of experimentation, while competitors transform their entire logic of operation and decision-making.

Conclusion

The case of Norges Bank Investment Management shows that Artificial Intelligence did not come to steal jobs, it came to reveal uncomfortable truths: inefficient processes, persistent biases, and decisions based more on tradition than on data.

The real challenge is not in implementing AI, but in seeing what it reveals. Technology is just the mirror; it is up to leaders to decide whether they have the courage to face their own reflection.

The future does not depend on AI itself, but on our ability to use this lens to correct what we are still unwilling to see.