Investing in Hardware: Why the Future of Innovation Depends on the Physical

Investing in hardware is no longer just a risky choice, it has become a central strategy for big tech companies. Tesla, Apple, Google, Amazon, Meta, NVIDIA, and Samsung already understand something much of the market still resists facing: hardware is no longer just a product, it is a platform. A foundation to scale software, capture data, and build barriers to entry.

What Investing in Hardware Means Today

When we talk about hardware innovation, we’re no longer limited to consumer gadgets. The focus is on large-scale data centers, advanced semiconductors, robotics, energy infrastructure, and global logistics. This is the new battleground between giants, because whoever dominates the physical infrastructure also controls the pathways of artificial intelligence and software.

Why Big Tech Bets on Hardware

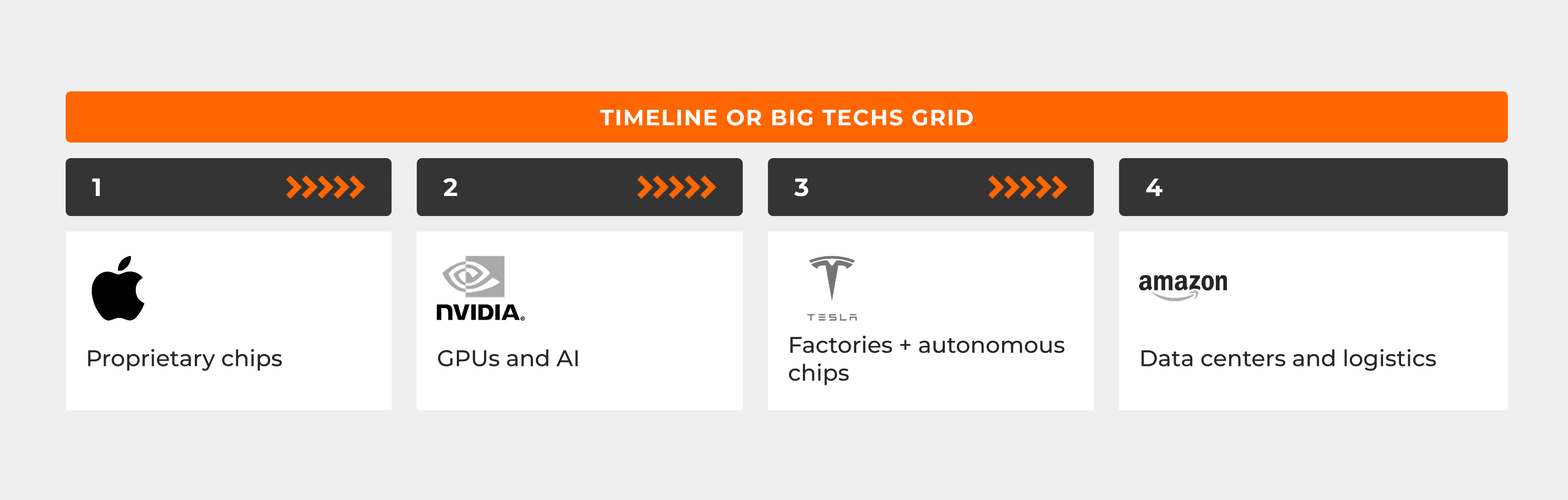

The strategy is clear: investing in hardware is investing in differentiation.

- Apple consolidated its ecosystem with proprietary chips and premium devices.

- NVIDIA turned its GPUs into the cornerstone of the AI revolution.

- Tesla invested in robotic factories and chips for autonomous driving.

- Amazon expanded its leadership in data centers and logistics with custom hardware.

These companies prove that hardware + software is the combination that ensures defensibility, enables data capture, and secures a strategic position in the market.

Hardware as Competitive Advantage

Investing in hardware is not just about building physical products, it’s about erecting competitive walls. Unlike software, which is easily replicated, well-executed hardware creates barriers to entry that are nearly insurmountable for competitors.

It also extends user retention cycles and consolidates real physical assets, whose value doesn’t vanish with market fluctuations.

This movement redefines the fundamentals of the game. Entrepreneurs betting on the physical world create solid bases to scale the digital and sustain long-term positions in an increasingly competitive landscape.

Venture Capital and the Hardware Dilemma

Although the mantra “hardware is hard” still echoes among investors, the reality is shifting. Traditional venture capital remains reluctant to fund long-maturation projects, but the rise of climate tech, deep tech, and applied AI is already pressuring a rethink.

Funds that recognize the potential of hardware–software convergence will play a central role in financing the next generation of global companies.

Long-Term Impacts

Investing in hardware also means investing in the future of society: Geopolitics: U.S.–China disputes over semiconductors and supply chains.

- Energy: The need for clean and resilient infrastructure.

- Work: Automation and robotics reshaping industrial productivity.

- Innovation: Building complete ecosystems sustained by physical assets.

Conclusion

The future of technology won’t be purely digital. It will be hybrid, physical and intangible at the same time.Companies that grasp this are building the invisible platforms of the next decade.

Investing in hardware is more than a trend, it is a strategic movement for those who want to shape the next ten years. The time for hesitation has passed. Those who move now will reap first.